We will need the following information to complete your taxes if applicable:

- Your Name & Spouse (if filing Joint):

- Your Address:

- Your Phone:

- SS#:

- DOB:

- Email:

- Copy of your ID

- All W2 Forms (From all jobs worked)

- Independent Contractor Forms (1099-MISC, 1099-K, 1099-G) you may have received

- Any receipts for business (if self employed or business owner)

- Any Profit and Loss Statements (if available)

- Unemployment form (1099-G)

- All kids or dependents information (Full Name, DOB, Social)

- Any Child Care / Dependent Care receipts with Agency Name, EIN and or Social

- Checking Acct# & Routing# (If you want your taxes direct deposit)

- Statement of Interest from the bank (1099-INT)

- Investment property forms or documents

- School form (1098-T)

- Mortgage form (1098)

- Copy of previous year Tax Return or Adjusted Gross Income (AGI) from previous year Tax Return

- Any PIN numbers from IRS to e-file your tax return

You can email all documents to us, and your tax preparation can be done electronically (No appointment necessary). Email documents to: support@getyourcreditbackontrack.com

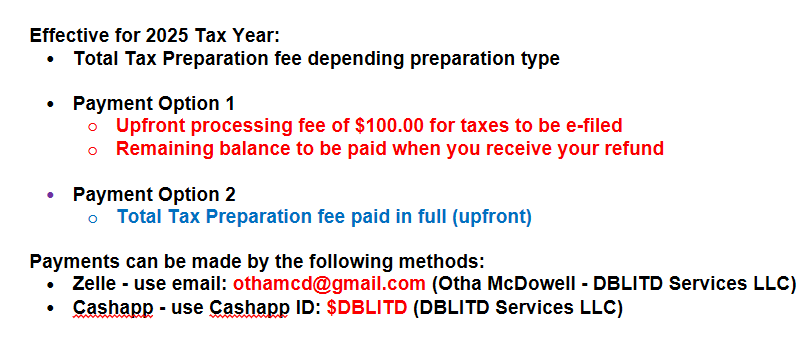

- Once we receive your documents, your documents will be processed

- We then send you your estimate, you verify all information

- Make your processing fee and once information is verified

- Your documents are E-filed

- You will received confirmation and a copy of your taxes when they are ‘Accepted’

IRS starts accepting E-Filing on Monday, January 26, 2026